4 Easy Facts About Private Schools Debt Collection Described

Table of ContentsThe Best Guide To Personal Debt CollectionDebt Collection Agency Can Be Fun For AnyoneThe Single Strategy To Use For International Debt CollectionRumored Buzz on Dental Debt Collection

The even more they recoup, the more they gain. Old financial debt that is past the law of limitations or is or else regarded uncollectable is bought for cents on the dollar, possibly making collectors huge revenues ff the customer pays. Debt enthusiasts have a track record for bugging consumers. The Federal Trade Compensation (FTC) gets even more problems concerning debt collection agencies and financial obligation customers than any other single industry.A collector that acts effectively will be fair, respectful, truthful, as well as law-abiding. After you make a written ask for verification of the financial debt you've been spoken to aboutwhich is your legal rightthe collector will certainly suspend collection tasks and send you a written notice of the amount owed, the company you owe it to, and also just how to pay.

It will also tell the credit bureaus that the item is disputed or demand that it be gotten rid of from your credit record. If the enthusiast works as a middleman for a creditor and also does not have your financial obligation, it will notify the creditor that it quit collection activity because it could not verify the financial obligation.

Reliable debt collectors will certainly try to get exact and complete records so they do not go after people that do not really owe cash. If you inform them the financial obligation was caused by identity burglary, they will certainly make a reasonable initiative to verify your case. They also won't try to sue you for financial debts that are past the statute of constraints.

How Personal Debt Collection can Save You Time, Stress, and Money.

Taking even the smallest action can invalidate the law of limitations as well as restart the clock. Debt collection is a genuine business. If a debt collector calls you, it's not always abusive. Lots of collectors are honest people who are simply attempting to do their tasks and will function with you to develop a plan to aid you settle your financial obligation, whether that implies a settlement in complete, a series of monthly payments, or even a minimized settlement.

A financial obligation collection agency can not contact you at the office or outside the hours of 8 a. m. to 9 p. m. A debt collection agency can not take cash from your paycheck unless they have consent to garnish your wages through a court order. It is very important to try to settle your financial debts to a debt collection agency before they take lawsuit.

If you are having a hard time with financial obligation that you are incapable to pay, you have several choices, including declaring for personal bankruptcy or discussing a settlement with the loan provider. Nevertheless, a number of your alternatives have downsides to think about too, such as the fact that your credit history will likely decrease. Consider seeking advice from a specialist monetary advisor to evaluate all the choices for handling your financial debt scenario.

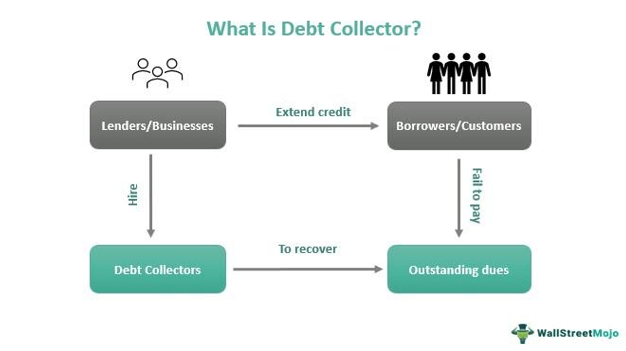

Tabulation You will possibly have come across financial debt debt collector, however who are Get More Info they and what can they do? A financial obligation debt collector, also called a debt collector, works with part of your creditors to accumulate debts you owe. Private Schools debt collection. They will deploy their representatives to call you or see you to request any arrearages that need to be settled

Get This Report on Dental Debt Collection

The financial debt collectors are most likely to receive a charge from your financial institutions for successfully gathering your cash. Financial debt collection agencies can be established to save your financial institutions time and cash. You will be alerted that this is taking place and who the financial debt collectors are, so you can be sure that the new individuals chasing you for money are genuine.

A debt debt collection agency can do this by: Contacting you Calling you Sending out a doorstop enthusiast to see your home (these people have no authorized power to take anything from you, unlike a bailiff) A debt debt collection agency is not permitted to pester as well as persistently call you. The Financial Conduct Authority's (FCA) guidelines state that consumers must be treated with 'forbearance as well as due consideration'.

If a financial obligation debt collector get in touches with your household, pals or work associates without your permission, they are in breach of FCA guidance. If they reveal any type of info regarding your hop over to these guys debts to any person without your permission, they are damaging the regulation. You will certainly be expected helpful site to pay back your debts, yet you do deserve to be treated fairly.

First of all, you should speak to the person/company who is pestering you as well as ask them to only call you by means of one interaction stream letter or phone for example. They have an obligation to your lenders to call you however they can not persistently send you endangering letters or call you throughout the day

Not known Details About Business Debt Collection

Some debt administration business, like Pay, Plan, provide totally free recommendations and can help find you an ideal financial debt solution if required. You don't need to bother with debt alone. Learn more regarding financial obligation as well as obtain cost-free, expert recommendations from Pay, Plan at www. payplan.com, Our advisors are here to help and they will certainly more than happy to speak to you regarding your financial circumstance.

As a result of a little modification in laws, the borrower is now reliant pay all prices of default procedures. What this suggests for you is 100% cost-free financial obligation collection on successful recuperation with Thomas Higgins. Under the Late Repayment of Commercial Financial Debts (Interest) Act 1998, you are entitled to declare back the costs involved with recuperating your debts.

As a result, by choosing Thomas Higgins for your financial debt recovery, there is no requirement for you to be out of pocket for going after cash that is rightfully your own. With an effective claim, not just are our costs covered yet as we don't charge payment or a percentage, you will certainly receive all of what is gotten from the debtor as well as at no additional expense.